While I have a rather boring investment style within the stock market, I think I balance it out a bit with the most volatile asset class out there. I’m, of course, talking about cryptocurrency. My adventure is still pretty recent, as I only started investing in cryptocurrency last January. Although it’s only been a few months, it’s been quite a ride!

So, in addition to my ETFs, I also have a crypto portfolio. By crypto portfolio, I mean everything I hold outside of my traditional registered accounts. That means I do not include any Bitcoin or Ethereum ETFs in this article.

Also, the term cryptocurrency is generally used, while not all crypto necessarily have a monetary purpose. Crypto asset or digital asset sounds much more representative to me, but I’ll use crypto just to avoid any confusion. 😉

I’ll give you details about what crypto is in my portfolio, how I buy them, how I hold them and how I manage everything. I will also, of course, give you some details on my returns to date. You’ll be able to see just how volatile it is!

Disclaimer

As always, please note that this article will not provide financial advice. I am still not a financial advisor, tax specialist or retirement planner (and never will be). Therefore, I am not legally authorized to make financial recommendations. Finally, I am even less of an expert on cryptocurrency.

This article is meant to provide an example of a portfolio and to be transparent, as always.

Please do not buy a specific crypto simply because I hold it. Keep in mind that past returns are never a guarantee of future return. If I’ve had success with a certain crypto in the last few months, it doesn’t guarantee that you will have by starting now. Always do your own research first.

Finally, this article includes many affiliate links to various exchanges and trading platforms. If you want to open an account on one of the different platforms, I invite you to use my links. This is a great way to support this blog. 🙂

Tax Clarifications

As mentioned earlier, crypto is not held in a registered account. Therefore, you need to understand that it’s subject to capital gains tax.

Be aware that a capital gain does not only occur when exchanging cryptocurrency for fiat currency. In fact, it also occurs when trading from crypto to another crypto (example: exchanging BTC for ETH). Thus, you have to trade carefully, or else the tax bill could turn out to be huge!

However, if you prefer to be a HODLer, i.e., a long-term investor in crypto terminology, then invest a little here and there (dollar-cost average), never sell and trade very little, and you will have (almost) no tax worries. 😉

My First Steps in the Crypto World

Last December, Bitcoin made headlines after breaking its last all-time high of 2017. This was followed by several new records and inevitably a correction of some magnitude in January. It seemed like a good time for me to get in. After reading and watching an embarrassing amount of content to understand the basics of Bitcoin and the blockchain, I decided to go for it.

I made my first BTC purchase on January 13th with the Montreal-based application Shakepay. By depositing $100, I got a $30 bonus by using someone’s referral link. Since Shakepay only offers BTC and ETH, I split my $130 between these two cryptocurrencies to start.

Since then, I’ve continued to invest here and there in $25 or $50 increments, dollar cost averaging my way to various prices. Daily, I continue learning about the market, the technology, the different trends and the other cryptos, also called altcoins. I eventually decided to acquire altcoins through different means, which I’ll detail below.

Of the different platforms I’ve tried, I still much prefer Shakepay. Their fees are very reasonable. The referral program, even though it has decreased ($10 now, instead of $30), is still very generous. Their feature to get free sats (smaller denomination of bitcoin) by shaking your phone every day is extremely generous. To date, I have made over $75 just by shaking my phone! And those sats will keep increasing in value!

I just wish they would add other cryptos besides BTC and ETH someday. It would make my process so much easier. 😉

My Portfolio

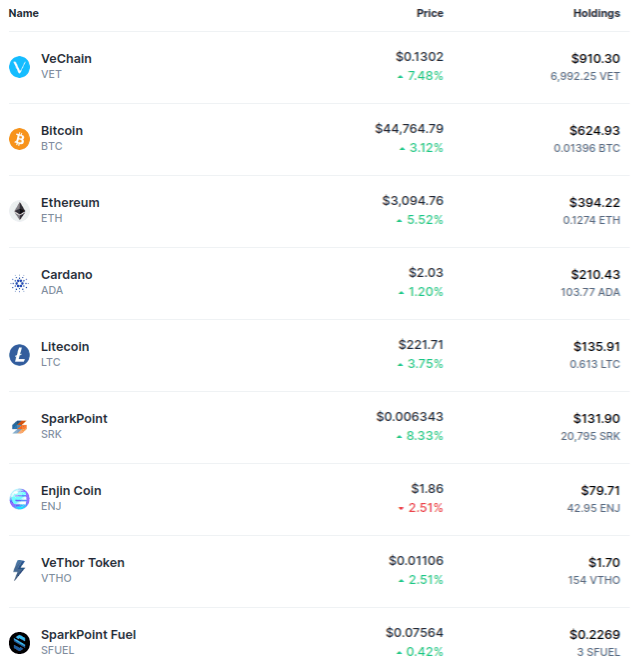

So here it is, my famous portfolio, as of today. Among my nine different cryptos, I only bought seven. The other two I actually generated on my own via different methods. And yes, it is a bit like if crypto could generate “dividends”. 😉

So I’ll briefly detail the cryptos in question, how many I have, where I buy them and where I keep them.

Bitcoin (BTC)

No need to even introduce it. Of course, I hold Bitcoin, the first cryptocurrency to appear on the market. Although the original purpose of Bitcoin was to become a digital currency, the slow transaction speed tends to suggest that it has more potential to serve as a store of value. So we’re talking more and more about Bitcoin being the digital equivalent of gold.

- How much I have: 0.01396033

- Where I buy it : Shakepay

- Where I keep it: BlockFI, where I get 5% interest

Ethereum (ETH)

Ethereum is another decentralized blockchain system with its own cryptocurrency (Ether). It serves as a platform for many other cryptos, in addition to running decentralized smart contracts.

- How much I own: 0.12738213

- Where I buy it: Shakepay

- Where I keep it: BlockFI, where I get 4.5% interest

Cardano (ADA)

Cardano is a blockchain platform that operates under the proof-of-stake consensus model. The project aims to redistribute power from unaccountable structures to the margins of individuals, thus helping to create a more secure and transparent society.

- How many I own: 103,77491

- Where I buy it: Bitmart

- Where I keep it: Exodus, where I get about 4% interest

Litecoin (LTC)

Litecoin (LTC) is a cryptocurrency designed to make fast, secure and low-cost payments. It was created based on the Bitcoin (BTC) protocol, but differs in terms of algorithm. Litecoin has a block time of only 2.5 minutes and extremely low transaction fees, making it suitable for microtransactions and point-of-sale payments. Litecoin somehow has more potential for real-world adoption as a currency than BTC.

VeChain (VET)

VeChain is a blockchain platform based on its own blockchain (VeChain Thor). The platform actually uses two different cryptos, VET and VTHO, to manage and create value on the blockchain.

VeChain is already being used by several major brands to monitor and track their supply chain. These include BMW, Walmart China, H&M and more.

- How many I have: 6,992.2461

- Where I buy it: Bitmart

- Where keep it: Exodus

Enjin (ENJ)

Based on Ethereum, Enjin is a company that provides an ecosystem of interconnected gaming products. Enjin’s flagship offering is the Enjin Network, a social gaming platform through which users can create websites and clans, chat and host virtual item stores.

- How much I have: 42.9524

- Where to buy it: Kucoin

- Where I keep it: Enjin Wallet

VeThor (VTHO)

VeThor Token (VTHO) plays a key role in the overall functionality of the VeChain Thor blockchain. The VeThor token is actually the price of using the blockchain. Its main purpose is to facilitate processes and transactions on the blockchain.

- How much I have: 154

- Where I get it: Exodus, because each VET held produces 0.00000005 VTHO about every 10 seconds (or every time a block is mined). So I never bought any VTHO until now, because my VET produces it by itself.

- Where I keep it: Exodus

SparkPoint (SRK)

SparkPoint or officially, SparkPoint Technologies Inc, is one of the pioneering crypto startups in the Philippines. The project aims to accelerate the adoption of blockchain and crypto by the general public through an ecosystem of products and services.

- How many I have: 20,795

- Where I buy it: Bitmart

- Or I keep it: Sparkpoint Wallet

SparkPoint Fuel (SFUEL)

SFUEL is a new DeFi (decentralized finance) token from SparkPoint Technologies Inc. The project also aims to accelerate mainstream adoption of blockchain and cryptocurrencies.

- How many I get: 3

- Where I get it: Bitmart, as I received through an airdrop as a reward for holding SRK.

- Or I keep it: Bitmart,because I don’t have enough to get it out and into the SparkPoint Wallet.

How I Keep Track of Everything

As you may have noticed, I buy, trade, and hold in several different places. So, it’s not as easy to see the big picture as it is for my traditional investment portfolio on Questrade.

Fortunately, there are plenty of tools, apps, or sites to get help. Personally, I use the Coinmarketcap website and app. After creating an account, I entered the details of my transactions and the number of assets I hold to see my portfolio all in one place.

So, as of the writing of this article (it fluctuates wildly 24/7), here is what Coinmarketcap shows me:

In addition to the overview, it provides other information. In particular, the number that really matters:

Here’s the total of my crypto portfolio as of the writing of this article. This amount represents just under 2% of my total assets. This is a percentage that I am very comfortable with right now. My thumb rule: don’t have more than you’re willing to lose.

So this allows me to see proportions of specific cryptos in my overall portfolio:

I’ll let you guess which one is my favourite. 🙂

It also allows me to see the progress of the portfolio and the many ups and downs of the market since I started buying:

As you can see, it’s been more of a roller coaster than anything else. Yes, my portfolio has dropped about 50% in the last month! Did I panic and sell? That’s not knowing me very well. Instead, I used what little cash I had to buy at a discount. 🙂

Passive Income, Bonuses and Thanks

Among all this, I actually invested $2,325 out of my own pocket, but I also got a lot of crypto through different methods. You saw all of that above. Some cryptos were simply given to me (VTHO and SFUEL). I was able to accumulate some BTC by shaking my phone with Shakepay. BlockFI gives me passive income in some of my crypto. Exodus gives me about 4% on ADA.

I’ve also received some referral bonuses from this blog. As of today, that’s a total of $455 in bonuses, broken down as follows:

I can’t say this enough, so I’ll repeat myself. Thank you to everyone who has used my referral codes so far. It is infinitely appreciated.

The Future of Crypto

We just experienced one of the biggest Bitcoin and crypto crash this past month. So, you may be thinking that I’m a bit crazy for staying the course. However, you should know that Bitcoin has been declared dead over 400 times since its inception. Despite its many alleged deaths, it remains the best performing asset of the last decade. Clearly, it is here to stay.

I don’t believe the end is near at all. Yes, there are many criticisms about energy consumption (among other things). However, we tend to forget that there are now a lot of other cryptos to consider that are immensely less energy consuming. Just think of a blockchain like Vechain that is operating under a consensus model (proof-of-authority) infinitely greener than Bitcoin’s (proof-of-work). Not to mention that their blockchain could soon be very useful in the effort to reduce greenhouse gases.

Ultimately, crypto will have to be considered as a whole, not just judged by its more energy-consuming figurehead.

Furthermore, volatility is the price you pay for performance. If you can’t stomach a sudden 50% drop in your portfolio, don’t even think about it. Close this article and go back to index ETFs right now. If you’re still interested, buckle your seatbelt, because it is quite a ride!

But first, get informed. Learn about it. If most of this article’s content sounds like Klingon to you, it’s time to do your own research before you buy anything.

Ultimately, remember that speculating on the short-term future is pointless when you believe in the technology and intend to hold these assets for the long term. In that case, buy and hold, baby. 🙂

Conclusion

So there you have it, that was my little crypto portfolio.

You may have noticed that I am clearly not a “maximalist”. Many like to get into debates about whether crypto X is better than crypto Y. Personally, I prefer to hold a little bit of everything. Just like in the stock market, I aim for diversification. I try to get exposure to different projects that I think show promise. Unfortunately, there are no ETFs composed of multiple cryptos for my TFSA (yet). So I’m diversifying on my own, anyway I can!

Also, four of my cryptos (BTC, ETH, ADA, LTC and VET) are in the top 20 largest cryptos, while the others are considered smaller caps. Two of these were literally given to me, so it’s not like I’m risking any of my money. Most of the small caps I actually buy are often with the bonuses I get. So even if I lose everything in these altcoins, I’m not really losing my money. I’m basically playing with house money! 🙂

And finally… I told you I didn’t have any Dogecoin. I have a high-risk tolerance, but there are limits. 😉

See you next time!